With Anthera Pharmaceuticals (ANTH) trading at near a 52 week low, investors are left wondering whether or not this is the start of a new trend? While Anthera may drop further based on an impending

Nasdaq delisting, however, it appears as though investors are set up for strong upside potential over the long term. In the pharmaceutical sector few things are certain, and things can happen at any time that drastically change a stock price. Investing in the pharmaceutical sector is not for the risk adverse investor. If you are interested in the pharmaceutical sector, Anthera is definitely a company to consider based on its strong risk/reward profile.

Pipeline

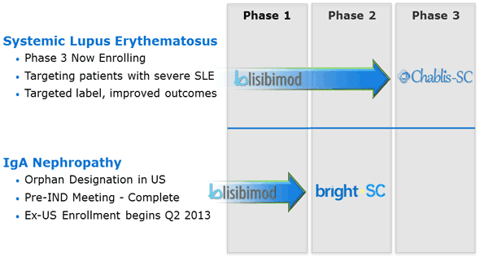

Any investor taking an interest in investing in the long term should look at the clinical pipeline of a company. Anthera has a promising pipeline, which should help to drive the long term growth potential of the company.

(click to enlarge)

As you can see from the graphic above, Anthera has pipeline that is rather advanced. With the orphan designation in IgA Nephropathy and Phase III enrolling in Systemic Lupus Erythematosus it is easy to see why there is a large amount of long term potential at Anthera.

Blisibimod

Blisibimod is the most advanced compound in Anthera's pipeline. It represents much of the long term future for Anthera, and should it be successful in clinical trials it represents a large amount of upside potential for investors. Just like with any drug trial anything can happen, however, it appears as though Blisibimod has set itself up to be very successful in upcoming clinical trials.

Systematic Lupus Erythematosus

Blisibimod is

entering phase III trials in Systematic Lupus Erythematosus. The phase III trial design is very important for Anthera, indeed phase III trial design can sometimes be the difference between an FDA acceptance and an FDA Complete Response Letter (CRL). In the case of Anthera, there will be two Phase III clinical trials conducted. These trials will be named CHABLIS-SC1 and CHABLIS-SC2. Anthera recently announced the initiation of CHABLIS-SC1. According to the

press release:

"The Phase 3 CHABLIS-SC1 study is a multicenter, placebo-controlled, randomized, double-blind study designed to evaluate the efficacy, safety, tolerability and immunogenicity of blisibimod in patients with clinically active SLE (SELENA-SLEDAI > 10) who have not achieved optimal resolution of their disease with corticosteroid use. The study will enroll patients from Latin America, Asia Pacific and Commonwealth of Independent States who will be randomized to receive blisibimod or placebo for 52 weeks after which they will have the option to receive blisibimod therapy in an open-label, long-term, follow-up safety study. The study will enroll approximately 400 patients and the primary endpoint will be a Systemic Lupus Erythematosus Response Index-8 (SRI-8). "

The relatively low enrollment of four hundred patients should be easily obtainable for Anthera. The trial protocol was developed based on discussions with the FDA, however, it is important to note that there is not a Special Protocol Assessment (SPA) in place in regards to the trials, which makes it possible that the FDA will later object to trial design and the endpoints. While I do believe that scenario to be unlikely, it is a factor that any informed investor would have to take into account before investing. Furthermore, Anthera's phase II study demonstrated that Blisibimod was successful in patients who had previously failed corticosteroid use. This conclusion was based on a subgroup analysis that was conducted by Anthera.

This leads us perfectly into talking about the subgroup analysis. Usually I am skeptical of any subgroup analysis in order to design a phase III trial, simply because there are many times where what happened in a subgroup in a phase II trial will not be repeated in a much larger phase III trial. In this case, however, it does appear as though the drug is destined to phase III failure because of the subgroup analysis.

Systematic Lupus Erythematosus already has a drug on the market. The distinction between Anthera's drug (should it ultimately be successful) and the current drug on the market will help to drive long term value towards Anthera. The other drug on the market is Benlysta, currently marketed by GlaxoSmithKline (GSK), and was developed based on a collaboration with Human Genome Sciences (which was later bought out by GSK for $3 billion).Benlysta has not been selling all that well, in 2012 the drug achieved

sales of $106 million, which was a disappointment for investors based upon all of the hype surrounding Benlysta's launch. Benlysta sales have been hampered, primarily due to the pricing of the drug. This is especially prevelant in some European countries including Britain and Germany.

In order to succeed where Glaxo has so far been unable to succeed, Anthera is going to need to accomplish a few key things. First of all it is going to have to be successful in obtaining a label that helps to distinguish Blisibimod from Benlysta. Anthera is well aware of the need to have a distinguishing label, saying in their most recent

conference call that:

"In parallel, we have conducted in-depth analysis of our own blisibimod PEARL-SC Phase II results. These combined analyses have proven to be very helpful in teasing out opportunities and guiding our own Phase III CHABLIS-SC1 trial design. Based on this analysis, eventual success of the CHABLIS-SC1 study could lead to an improved product label , better patient identification for initial product trials at launch and better success in penetrating and growing the SLE market."

Knowing about the need for unique labeling is important for long term oriented investors, as the company will need to stand out to really have a chance. It is also important for investors to note that Anthera has been conducting an analysis of Benlysta's phase III program in order to develop the CHABLIS-SC1 trial. While this would immediately sound encouraging to investors, it should be taken with a grain of salt given the idea that we do not know how much of an influence the Benlysta studies had upon Anthera's own study design.

Also, it is likely that Anthera will have to attract a large pharmaceutical partner in order to successfully market the drug in SLE. The problem is that it is possible that there would be less interest from large pharmaceutical companies, simply based on what has happened up to this point in regards to Benlysta.This actually sets Anthera up for an interesting position, in which it wants Benlysta to do well and to meet its projected sales expectations. Companies would then observe the market penetration of Benlysta and if Anthera's compound is successful in clinical trials, they might partner with Anthera in order to take a stab at the growing SLE market and to take on Benlysta. If Anthera were going to partner the drug, they would probably do it after the receipt of the Phase III data. This would be a long term oriented catalyst, given that the Phase III study has an estimated primary completion date of

December 2015.

As CHABLIS-SC2 starts to come on line, according to the company they plan on meeting with the FDA next quarter in order to discuss the path forward. From the conference call, you can see that the CHABLIS-SC2 study is going to differ from the SC1 study.

Moving on to the status for the second lupus study. We hope to capitalize on the growing body of clinical evidence that blisibimod will provide significant benefit to lupus patients who have high levels of renal involvement, including patients with stable lupus nephritis/glomerulonephritis.

The CHABLIS-SC2 study could be what helps to separate Blisibimod from Benlysta. This study could provide Blisibimod with a broader label than Benlysta, and as such help to improve the market potential of the product.

The market potential for Blisibimod is very hard to predict, simply because it would depend upon the clinical results and the labeling for Blisibimod. While sales potential is hard to predict, it is definitely much more than Anthera's current $80.43 million market cap. The SLE market represents a very enticing market for long term oriented investors, should Anthera be successful in phase III testing, and obtaining FDA approval.

The following table is a rough sketch of the pending long term catalyst in regards to Blisibimod for the treatment of SLE.

Long term catalysts for Blisibimod in SLE

| Catalyst | Estimated Time Frame |

| CHABLIS-SC1 Completion | December 2015 |

| CHABLIS-SC2 Completion | 1Q 2016 (this is a guess based on how far behind CHABLIS-SC2 is in terms of initiating a clinical trial) |

| Partnership | Hard to predict, either before the NDA or after FDA acceptance |

| NDA Filing | 3Q 2016 (this is conservative) |

| PDUFA | 3Q 2017 (assuming standard review) |

This table was illustrative in regards to a couple of ideas. First of all, investors are not clear on how far behind CHABLIS-SC2 is, and exactly what the design specifications are. It is possible for SC2 to catch up to SC1 based on patient enrollment amongst other factors.

I am not, however, saying that these are the only catalysts in regards to Blisibimod and that investors should simply lock up their money until 2015 based on the hope that Blisibimod works. Blisibimod is also being pursued in other indications, which have the potential to be financially lucrative for Anthera, as well as has the potential to create some more catalysts for long term oriented investors.

IgA nephropathy (IgAN)

Anthera is also pursuing Blisibimod in a potential indication for IgA nephropathy. IgA nephropathy is a chronic immune renal disease that is typically characterized by proteinura and can sometimes progress to end stage renal disease. Blisibimod would have a relatively large market, should it be approved for the indication.

Anthera recently announced that it initiated a

phase II trial called BRIGHT-SC for Blisibimod in IgA nephropathy. This clinical trial has the ability to provide near term catalysts for shareholders, as the trial progresses towards its completion. According to the press release (cited above), this trial appears as though it will be shorter:

"BRIGHT-SC is a multicenter, placebo-controlled, double-blind, Phase 2 clinical study that is expected to enroll at least 48 patients from Asia Pacific geographies. Patients will be randomized into one active treatment arm or one placebo arm. The primary endpoint of the study will be a reduction in proteinuria at 32 weeks. The Company plans to conduct an interim analysis of proteinuria after patients have completed 8 weeks of therapy. Secondary endpoints will include the effects of blisibimod on estimated Glomerular Filtration Rate (eGFR), plasma B cells, and other biomarkers of kidney disease."

The interim analysis at 8 weeks should help to provide a closer catalyst for shareholders. Also, it should not take all that long for Anthera to enroll at least 48 patients in the phase II trial. However, if Anthera increases the enrollment before seeing any of the data, it could be positive for shareholders as the more subjects in the Phase II trial would help to give shareholders more confidence in the Phase III development program. This trial was designed after a May meeting with the FDA. Anthera hopes to present interim data early next year.

The market opportunity for IgAN could be quite large for Anthera. Anthera estimates that there are 40,000 people in the United States affected by IgAN This number could actually be low because it seems as though IgAN is underdiagnosed due to the fact that it requires a biopsy, which is not normally completed for patients who have mild urinary abnormalities. The clinical development of Blisibimod in IgAN represents a significant catalyst for shareholders, and could help to drive long term shareprice growth. Significantly, according to the conference call Anthera estimates that there could be millions of people affected by IgAN in Asia, where the prevalence of the disease is much higher.

Another significant idea about the development of Blisibimod in IgAN is the fact that the disease is an orphan disease. What this means is that due to the fact that there are so few patients who have the disease, if the FDA grants orphan drug designation, the recipient will have market exclusivity for a certain time period as well as other benefits. Typically, orphan drugs can be quite profitable, as companies will substantially increase the price of the drug in the orphan indication, because they are the only drug on the market. This further increases the commercial potential of the IgAN indication for Anthera.

Risks

In order to provide readers with a full view of what the risk/reward is for this stock, it becomes necessary to address some of the risks associated with Anthera. If Blisibimod is found to not work in any of the indications above, the company would not be worth very much money at all. The company has taken a risk by having Blisibimod being the only drug in their pipeline, and if this drug is not successful Anthera would have to develop another pipeline essentially from scratch. Another risk associated with Anthera is that it could be harder for them to raise money given the fact that they might be

delisted from the NASDAQ soon.

Financial Position

It appears as though Anthera has a rather stable financial position. At the end of March 31,2013 Anthera had $54.4 million in cash. The company mentioned that the amount of cash is "sufficient to deliver on a number of milestones over the next 12 to 18 months." I would expect this to be correct, as from operating activities, Anthera had a

negative cash flow of approximately $10.63 million. This means that Anthera's cash pile should last roughly through the next five quarters assuming that the expenditures roughly stay the same, and assuming no unexpected revenue.

While it is concerning for any company to be cash flow negative, in the case of Anthera I am not overly concerned. Many development stage pharmaceutical companies operate at net losses until their first drug gets on the market (unfortunately, some companies never end up being positive). With this in mind, it is not unusual for Anthera to have a negative cash flow and a net negative in terms of operating expenses. With a cash pile of $54.4 million, the company has removed the immediate risk of dilution for shareholders who take a position. By the time that Anthera would have to raise more cash, it should be at much higher prices due to drug development, we should have Phase II results in IgAN in that time and have a pretty good idea about whether or not the phase III enrollment is on track in SLE.

Conclusion

Anthera is a very interesting long term proposition. While there may still be some short term downside in Anthera's shareprice, with Anthera trading near its 52 week low it appears as though this is a fantastic risk/reward opportunity for investors. Anthera's holdings have also been relatively stable, with

institutional ownership of 48.93%, it appears as though Anthera will be a good long term investment. As Anthera progresses Blisibimod through the requisite clinical pipeline, there should be an appreciation in share price. Anthera appears to be a small cap stock with asymmetric long term upside potential.